Thus it was not surprising to see this article in the WSJ

Flows Return to Emerging Markets

Investment

Flows Take Pressure Off Emerging-Market Governments

By

MICHAEL

S. ARNOLD in Hong Kong,

PATRICK

MCGROARTY in Johannesburg and

EMRE

PEKER in Istanbul

Updated June 17, 2014

1:29 a.m. ET

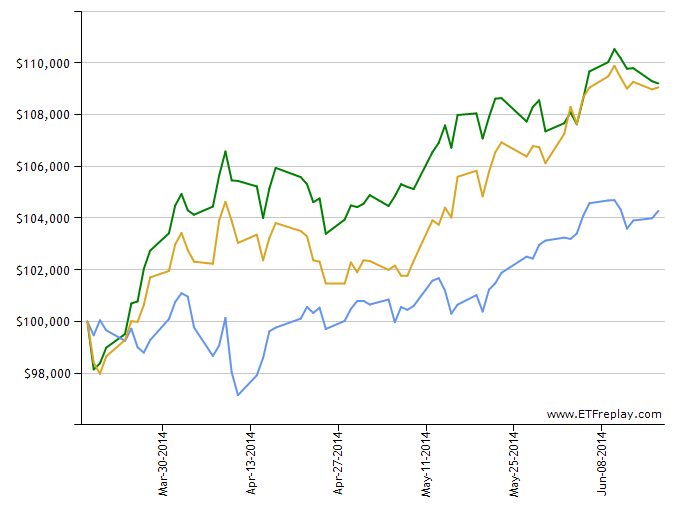

A fresh wave of investment inflows is taking the pressure off

some emerging-market governments that had at long laststarted to tackle

economic overhauls.

As investors fled from developing markets around this time last

year, in anticipation that U.S. interest rates would climb when the Federal

Reserve reined in its stimulus measures, central banks in Turkey, Brazil,

India, Indonesia and South Africa raised rates to stanch capital flight and

many nations promised tough economic measures to restore confidence.

Investment flows have since reversed, sparked by bets that

interest rates will remain near zero in the West well into next year. That has

allowed emerging-market nations to defer hard policy choices and could hold

back world economic growth.

Investors pulled $32.5 billion out of stocks and bonds of 30

emerging markets in June 2013, the height of market turmoil, according to the

Institute of International Finance Inc. Political upheaval in Ukraine in

January led to a further bout of outflows.

But investors have pumped $221.7 billion into emerging assets

over the past 11 months, including an estimated $45 billion in May, the highest

monthly total since September 2012.

No comments:

Post a Comment