Investors especially "sophisticated" ones seem to

perennially be in search of "alternative " assets particularly hedge funds.

Yet over and over again these funds show poor performance.

Furthermore with their 2+ 20"

standard fee structure (2% management fee and 20% of profits) the hurdle for

even a successful hedge fund manager to produce superior returns for clients is

quite large.

But the WSJ reports the hunt for alernative assets particularly hedge funds keeps growing among pension funds and endowments.

http://online.wsj.com/articles/big-investors-missed-stock-rally-1403567478

Consider this: investing in an ETF with a

management fee of .20% (many can be found for half that fee) a 10% gain

in the underlying assets held by the etf would mean a 9.8% return to the

investor.

On the other hand for the investor paying

"2+20" the 10% return on the underlying portfolio of the hedge funds

would mean 6% net return for the investor.

And that is even without the dismal

performance described here

Corporate pension funds and university endowments in the U.S.

have missed out on much of the rally for stocks since 2009, following a push to

diversify into other investments that have had disappointing performances.

The institutions, ranging from

large corporations such as General Motors Co.GM +0.44% to

big universities such as Harvard, have been shifting to hedge funds, private

equity and venture capital. But while these alternative investments outpaced

stocks during 2008's market meltdown and are seen as potentially less volatile,

they have badly lagged behind the S&P 500 since 2009, a period in which

U.S. stock indexes have more than doubled.....

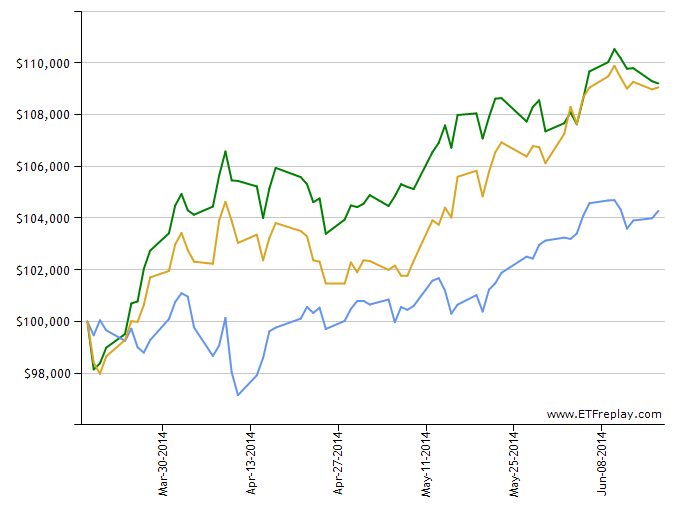

The shifts haven't worked out lately. Since the start of 2009,

when the market began rallying, the S&P 500 has climbed 137%, including

dividends, to record levels. By contrast, the average hedge fund is up 48%,

according to research firm HFR Inc., while the average hedge fund that is

focused on stocks has risen 57%. Over that same time, private-equity funds have

climbed 109% on average, while venture-capital funds rose 81%, according to

Cambridge Associates.

I must say I was shocked at the high percentages allocated to

alternatives relative to stocks particularly among college endowments:

The average college endowment had 16% of its investment

portfolio in U.S. stocks as of the end of June 2013, the most recent academic

year, according to a poll of 835 schools conducted by Commonfund, an

organization that helps invest money for colleges. That is down from 23% in

2008 and 32% a decade ago. The 18% allocation to foreign stocks didn't change

in that period. Schools in the poll, which collectively manage nearly $450

billion, had 53% of their funds in alternative strategies, up from 33% in 2003.

The pension fund numbers are shocking as well:

Among large U.S. companies with

small allocations to stocks in their pensions, shareholdings ranged from 5.2%

at NCR Corp. to

14% at Prudential

Financial Inc.and TRW Automotive Holdings Corp to 15%

at Ford Motor Co. to

18% at General Motors to 19% at Citigroup Inc., as of the end of

fiscal 2013, according to Milliman and data provided by the companies.

At one time use of alternatives if at all was seen as a

complement to a more straight forward allocation to stocks and bonds offering

lower fees and more liquidity....things have changed radically.

I dont know who is managing the money managers here...but it seems to me as fiduciaries of these monies...somebody should be taking a closer look. Maybe old fashioned boring common stocks merit a bigger allocation in these portfolios.