I dont't think I have seen so much bad advice for individual investors in a single article since the WSJ began its personal investing column entitled my comments in blue

How to Play a Market Rally

Stocks Have Surged—but Investors Who Want to Lock In Some Profits Now Need to Do It Carefully

By BEN LEVISOHN and JANE J. KIM

The article starts off with this beaut:

Forget "buy and hold." It is time to time the stock market.

For 10 long years, market rallies have ended badly for investors. Now, with stocks up 15.6% in four months, strategists are beginning to suggest that ordinary investors start dialing back on risk.

first of invvestors with a globally diversified portfolio + an allocation to bonds haven't had such a bad ten years certainly compared to someone who invested 100% in the s+p 500 the "benchmark" for the "lost decade" No informed investor would hold that 100% sp 500 portfolio.

The first step is to disabuse yourself of the notion that it's impossible to time the market. It turns out that sometimes you can. When markets are stuck in a trading range for an extended period, selling into strength and buying into weakness can outperform buy-and-hold investing.The article goes on to give 2 simplistic market beating formulas

If that sounds like sacrilege, it may be because mutual-fund firms have spent decades persuading you to keep your money in their stock funds through thick and thin so they could collect bigger profits.

Consider an investor with a $1 million portfolio on Dec. 24, 1998, the first time the Standard & Poor's 500-stock index was at its current level. But if the investor had merely held on, he would have seen essentially zero appreciation through Nov. 11 of this year. If that same investor instead had sold one-tenth of his portfolio every time the stock market gained 20% and allocated one-fifth of his cash to the market when stocks fell more than 10%, he would have gained about $140,000, according to a Wall Street Journal analysis

and here's market beating strategy #2

An approach using broad valuation measures performed even better. One metric, the ratio of stock-market capitalization to gross domestic product, tracks the market's value versus that of the underlying economy. An investor with $1 million on Dec. 24, 1998, who sold 10% at the end of each month when the ratio was above 115% and bought stocks with 20% of his cash when the ratio was below 75%, produced a gain of around $365,000. (The average has been about 91% over the period

but they themselves admit their "market beating formula " would have failed to outperform the market since 2002. They give no data for any other periods including any prior to 2000-2009. I wouldnt suggest the authors quit journalism to start a hedge fund based on their market beating formula.

They then go on to recommend 4 investment moves 2 of which are absolutely disml:

The first:

Go Anywhere Funds

Investors who wish to take some profits on stocks and redeploy it elsewhere should consider "tactical allocation" mutual funds that allow managers to jump into and out of asset classes at will.Was it the brilliance of the manager or the simple fact that these funds held non US stocks and bonds that produced that performance ? How much better did they do than a well allocated global stock and bond index portfolio. And what good is a performance number from a category when strategies can "go anywhere" and there is no persistence of performace among active fund mangers

When the stock market trades in a band, as it has for the past decade, these sorts of funds can perform well. According to data from investment-research firm Morningstar Inc. through October, "world allocation" funds have returned 5.08% annually over the past five years and 5.78% annually over 10 years, compared with the S&P 500's 1.73% annualized gain over five years and an annualized loss of 0.02% over 10 years.

Some tactical funds handily beat traditional equity funds during the financial panic.and of course many didn"t:

"There were many investors in 2008 and 2009 who were disappointed by how little their fund managers could do to react to or react ahead of what was developing," says Loren Fox, senior analyst at research firm Strategic Insight.

And of course the mutual fund industry is never slow to jump on a fad so that investors cant put money into a strategy based on past performance of a few standouts and put money in funds that have zero perfomrnace data. :

So far this year, financial-services firms have launched 28 world allocation funds, according to Morningstar.

This Advice May be Even Worse:

A typical move after a powerful stock rally is to sell shares and buy bonds. But with the Treasury markets surging to record highs recently, putting more money there could be even riskier than leaving it in stocks.

true for investors in long duration bonds where a 20 year duration bond would cause a loss of 20% on a 1% move up on interest rates. But move the duration down to 3 years and that number is 3%.

Their suggestion "rising rate funds" which are really floating rate funds...: with plenty of credit risk.

Instead of Treasurys, investors should consider "floating rate" funds, which buy variable-rate corporate loans—and therefore collect more money when rates rise. In 2003, for example, when the Fed started raising rates, floating-rate funds gained 10.4% while short-term bond funds gained 2.5%, according to Morningstar.

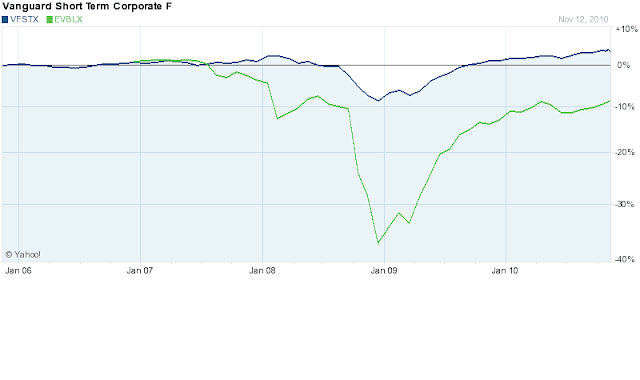

There are at least 31 open-end funds and 10 closed-end funds to choose from. Morningstar's picks in this category include the Eaton Vance Floating-Rate Fund (evblx)and the Fidelity Floating Rate High Income Fund,(fahyx) which boast experienced management teams and solid track records.

Warren Ward, a financial adviser in Columbus, Ind., says he is considering the Fidelity Advisor Floating Rate High Income Fund for his clients because of manager Christine McConnell's experience through up and down markets.

These funds hold bank loans which carry high credit risk and are illiquid. As a consequence they are disastrous during periods of panic when liquidity dries up and the default risk of these loans rises. In 2008 the fund dropped 30.41% even with a 46% recovery in 2009 an investor in this fund who put money into the fund in 2007 and had the stomach to hold on has underperformed someone who simply invested in the aggregate bond index by 3.85% in annualized return. The Fidelity fund which of course gets its "high income" really high yield from higher credit risk, plugned 38.9% in 2008.

High risk bond funds are not a good place to diversify away from stock market risk. The risk in these funds is more akin to the highest credit risk bonds = high yield as the two charts below show comparing the funds to the low cost vanguard high yield bond fund (vwehx)

No comments:

Post a Comment