A touch of reality in the actual inflation data released today:(wsj)

Inflation Remains Muted

U.S. consumer prices continued to rise modestly in October on the back of higher gasoline prices, but underlying inflation was flat for the third month in a row.

Separately, home construction in the U.S. plunged to the lowest in 18 months during October, an indication that the moribund industry's recovery is sluggish.

The seasonally-adjusted consumer price index last month rose by 0.2% from September, the Labor Department said in a report Wednesday. It was the third consecutive month that higher energy costs helped to push prices up.

However, the so-called core inflation rate that's more closely watched by the Federal Reserve was unchanged as the price of new and used cars fell. Taking out energy and food prices that can be volatile from month to month, underlying consumer prices have not moved since July.

The annual underlying inflation rate hit 0.6%, the lowest level since records began in 1957. That's well below the Fed's informal inflation target of between 1.5% and 2.0%.

Today's WSJ has an excellent article on how employment and inflation are linked at the hip

...U.S. consumers, in other words, are hardly better-equipped today to handle higher prices. That is no small matter. It limits the risk of an inflationary outbreak. If consumers don't have rising incomes or savings to pay for higher food and energy costs, for example, they will have to adjust by pulling back on spending elsewhere. That is a deflationary, not an inflationary, outcome. In previous inflationary periods, such as the mid-1970s, employment income posted annual growth as high as 10.2% in mid-1974, notes Moody's Capital Markets. Through September, it was up just 2.5% from the previous year. And "we're still potentially looking at a further deceleration of wages," says the group's chief economist, John Lonski, as part of the "market-clearing process" of putting the unemployed back to work.

This helps explain why companies from Cisco Systems Inc. to Wendy's/Arby's Group Inc. are reluctant to raise prices, even if their own costs are often climbing. Wal-Mart Stores Inc., for example, is offering $9 Wrangler jeans, $59 digital cameras and free online shipping this year in an effort to lure holiday shoppers.

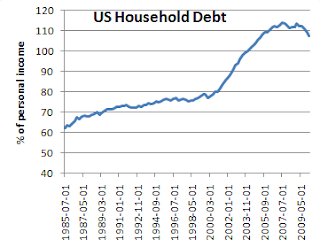

If inflation is too much money chasing too few goods the money has to be earned in wages and spent. The fed actions may not get the economy going but that will only be if corporations and banks continue to sit on their cash . As for consumers looking at this chart it seems household debt may be a big restraint on future spending (although never rule out the american consumers propensity to use their credit cards)

But what about commodity prices and future inflation. ?As anyone that is following the commodity markets at all knows, commodities are extremely volatile subject to speculative excesses and short term factors like weather or political risk. There is no doubt that these factors add to the short term voaltility of commodity prices, their impact on longer term prices (and long term prices) is more questionable. As the economist writes:

Here's a chart form Paul Krugman's blog (whatever you think about hsi politics he brings great graphs on his blog)Fund managers, who allocated a pittance to commodities a few years ago, now put up to 5% of their cash into them. Commodities diversify portfolios: in theory, at least, price moves are uncorrelated to shares and bonds. They act as a hedge against a depreciating greenback. And since 2005, when China began importing huge volumes of raw materials, commodities have also offered exposure to its rise.As the sums devoted to commodities have grown, so have complaints about the damage that speculative cash causes. Investors came under heavy fire in 2008 as the price of oil and food raced upward. More recently they have been knocked for rises in wheat and corn prices. Yet the benefits that investors bring—the liquidity and price information that make for efficient markets—barely get a hearing.In fact there is little empirical evidence that investors cause more than fleeting distortions to commodity prices. The most persuasive explanation for the rises and falls of commodities is demand and supply. In 2008 a still-growing rich world and a boom in developing countries pushed demand for oil and food up against the limits of supply. Wheat prices spiked this August after a drought and fires in Russia, an important supplier, prompted an export ban. The recent surge in sugar prices comes after a bad harvest, that of corn after official warnings of a lower-than-expected crop.

The graph illustrated the economist's assertion there is a large short term variation around the long term trend in commodities. The long term trend is up due to the emerging markets growth story, but commodity markets even more than capital markets overshoot. What that means for investors is that a long term allocation to commodities makes sense and those large fluctuations create great opportunities for that long term investor to take advantage of those large fluctuations to sell high and buy low to reap the "rebalancing premium".

And what about those grocery prices and the claim that the cpi which is ex food and energy is disconnected from the grocery prices consumers see every time they shop. Here's another graph from Krugman

This shows inflation over 10, 9, 8 ....1 year periods. Blue is groceries red is cpi . Krugman writes

What we see is that grocery prices have tended to rise faster than inflation as measured by the core CPI, but not by all that much: over the past 10 years the grocery inflation rate has been about half a point faster than the core inflation rate. If you look at more recent data, what you see is that grocery prices have bounced around; if you’re asking about the one-year inflation rate, grocery prices have risen somewhat faster than the core rate, but over the past two years grocery prices are actually down.

Does this look to you like a situation in which real people experience soaring inflation,

The fed may be" pushing on a string" and QE2 may quite possibly (for the reasons cited above among others) not turn the economy around. But inflation should be well down on the list of investors worry list.

No comments:

Post a Comment