High yield bonds have had a major recovery since the ugly

2014 (measured in total return HYG the largest high yield ETF is up over 8% in the past 3 months) showing that they are an asset class that only works for long term

investors. Further complicating matters is the fact that changes in the bond

market with dealers holding last inventory and less willing to take risks after

market makers have reduced liquidity in this market. Less liquidity means more

volatility and of course the liquidity dries up just when performance chasing

investors want to sell creating a vicious cycle.

Unlike Treasury bonds or even investment grade high yield

bonds won’t form a buffer to a portfolio in times of crisis. But they may offer an attractive addition to

a portfolio as an asset with risk between those of stocks and those of treasury

bonds and investment grade bonds. The NY Times recently presented a good overview of the high yield bonds' role in a portfolio,

With US stock valuations high based on historical measures

and yields on junk bonds—despite the recent rally—well above long term averages

it may still be a good opportunity to add high yield bonds to a portfolio. In

the long term asset classes show a reversion to the mean in valuations with US

stocks at high historic valuations and high yield bonds – even after their

recent rally— are still at relatively low valuations it may be a time to consider

incorporating high yield bonds in a portfolio allocation…but only for those who

consider it as part of a long term investment strategy.

As is the case in most asset classes investors tend to chase

performance and thus miss out in the long term returns. This is certainly the

case with high yield bonds. Below are graphs of fund flows and below that

changes in yield spreads –the differential between high yield and investment

grade vs treasury bonds, lower spreads mean higher prices.

Nor surprisingly the flow of investor money chases

performance with outflows at the bottom in price (high in spreads) and vice

versa.

:

And here is a chart of the high yield bond ETF HYG as can

been seen high yield bonds are not for the faint of heart. Matching this chart

against the flow of funds chart above shows the outflows matched price declines

and the inflows chased the advances in price. One can observe here a spikes up in volume (bottom scale)at the lowest price levels..indicated large scale selling..

.

On the other hand, disciplined investors who allocate a

portion of their assets and use a disciplined rebalancing strategy can reap the

benefits of an allocation to high yield.

Perhaps more than other asset class, high yield bonds have a very clear

pattern of reversion to the mean: when yield spreads move to extreme levels

they return back closer to long term averages. This makes them a particularly

good asset to benefit from those that use discipline in rebalancing. Selling part of the allocation after large

increases in price (spreads well above the mean) and vice versa gives excellent

opportunity for a “rebalancing premium” in this asset class…as well as reducing

risk.

Here is a longer term chart of credit spreads.

So where do High Yield bonds belong in a portfolio. A recent

NYT article discusses this. High yield bonds fall somewhere between stocks in

terms of risk and return. Given the attractive cash flows from such investments

and lower volatility than stocks they might be seen as an attractive

alternative to dividend and dividend growth stocks in generating cash flow from

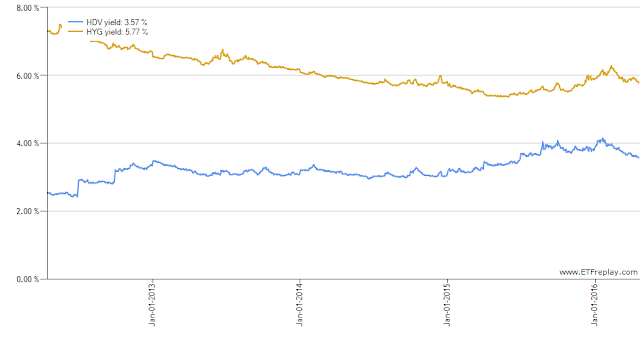

a portfolio. For example, at present HYG currently carries a yield of 5.77% vs

3.57% for HDV the high dividend ETF and has consistently carries a yield well

above that of HDV. Below is a three-year graph of the yields for HYG and HDV

A few more graphs of interest.

Long term chart of total return (growth of $1) high yield

index vs US stocks (Russell 3000 index), US investment grade bonds and US treasury bonds

And the risk return graph used to show the “efficient frontier”

how asset classes line up in terms of risk and return.

|

The graph shows that

in fact high yield investors are compensated for the risk they take relative to

treasury bonds. And that the risk/return is between that of US stocks (Russell

3000) and the US treasury bonds. In fact, the risk return tradeoff (added risk

vs increased return) high yield bonds look attractive compared to credit bonds indices which include investment grade and high yield. That is logical since in times of financial crisis spreads between

both investment grade and high yield bonds both widen considerably (decline in

price) during periods of financial stress. As many have observed the only thing that goes up in such markets is correlation among risk assets. Only treasury

securities and cash offer a shelter in those conditions.

The long term disciplined investor can benefit from a long

term allocation to high yield bonds…but only for those with the fortitude to

hold on to their allocation during periods of share declines. And disciplined

enough to sell high and buy low in rebalancing.

Current high historic valuations for US stocks and low

historic valuations for high yield bonds may make it an opportune to consider

initiating such an allocation.

No comments:

Post a Comment